Verizon myPlan Brings Choice and Flexibility to the Wireless Bundle

Bottom Line

Verizon is hoping to bring growth back to its consumer wireless business by simplifying its core price plans and adding a build-your-own-bundle element. myPlan is unusually flexible, which is both a benefit and a drawback.

Analysis

Verizon spent a decade cementing the “best network” message in consumers’ heads, and for a long time, that was enough. T-Mobile and Sprint competed on price, and AT&T milked its early lead with the iPhone as long as it could. However, in the John Legere/Mike Seivert era, T-Mobile improved its network, and AT&T discovered that it could juice subscriber numbers with richer device incentives and connected cars. Verizon has corrected its early dependence on mmWave with a robust C-band network that will only get better as more spectrum is allocated next year, but in the meantime, its consumer business has suffered. (The enterprise business, on the other hand, is flourishing.)

Verizon needs to shake up its consumer wireless business, but it doesn’t want to compromise margins or damage its premium brand by starting a price war. The new myPlan radically simplifies the company’s six unlimited plans down to two, and then asks consumers to create a custom bundle of additional services (“perks”). Alternately, they can choose from pre-configured bundles. Existing Verizon subscribers can scan a QR code at retail to have an AI-driven custom bundle suggestion based on their existing plan and usage. (You knew there had to be an AI angle here somewhere.)

Unusually Flexible

myPlan is unusually flexible for a wireless carrier and enables Verizon to add or subtract elements down the road, which could be an effective way of targeting specific market segments and demographics. That flexibility also enables rich customization for consumers, but to get the most out of it, consumers will want to actively manage their plan, which is a bit of a mindset change. Verizon is not forcing consumers to switch to this plan. In the short term, it may lose some revenue as some subscribers de-bundle to save money. However, longer term, Verizon expects myPlan to add to ARPU as consumers take advantage of more perks.

The two unlimited plan options include “5G,” but Welcome Unlimited is only low-band 5G. To get fast C-band and mmWave 5G – i.e., speeds noticeably faster than 4G – you’ll want Unlimited Plus, which costs $15/month more per line. You can mix and match Welcome Unlimited and Unlimited Plus among different members of a family plan, and, like most postpaid plans, the initial line is expensive on its own ($65 for Welcome Unlimited, 80 for Unlimited Plus), only dropping down to $27 or $42 per line with five or more lines in the plan. To confuse things further, Verizon advertises the four-line starting point of $30/$45. Overall, the pair of base plan options are certainly less complicated than Verizon’s previous six offerings, but it still took me a whole paragraph to describe.

Evaluating The Perks

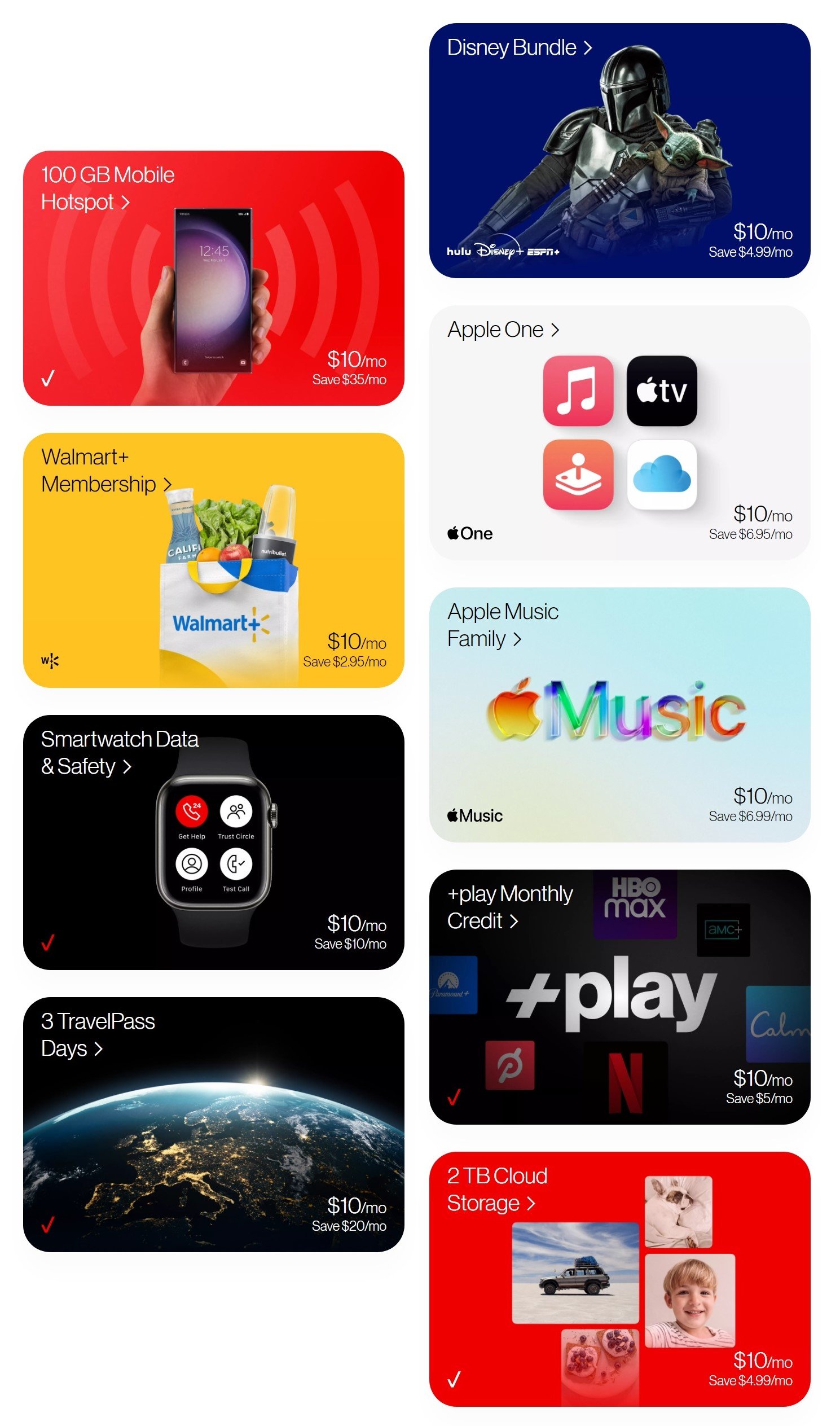

Verizon is starting myPlan with nine perks to choose from, and each perk is assigned to a single line. Perks can be turned on or off on a monthly basis using an app – no call to customer service required. Nearly all perks cost $10 per line per month and represent a $3 - $7 discount from what you would pay outside of Verizon (at least for the third party services). I commend the Verizon product manager who figured out how to homogenize disparate services and into two easy to digest digits. However, actually putting together an optimized plan can get fairly complicated.

Here is how each perk stacks up:

Disney: Hulu (with ads), Disney+ (no ads), and ESPN+ (with ads). Disney doesn’t offer this specific combination itself anymore – to get Disney+ without ads direct from Disney costs $11/month on its own, the trio of services with ads is $13/month, and for the trio without ads on Hulu and Disney+ is $20/month. That makes Verizon’s combination for $10 a terrific value.

Apple One (individual, $10; family $20): the individual Apple One plan including Apple Music, Apple TV+, Apple Arcade, and iCloud+ is $7 less expensive than buying it directly from Apple. This deal is so good that it could convince some people to use more Apple services.

Verizon is also offering the family version of Apple One as a $20/month perk, which is a $3/month savings vs buying directly from Apple. This option allows you to buy just this one perk assigned to one line on your plan and then share those Apple services across five Apple user IDs.

Apple Music (family): What if you want to split the difference? If you don’t need everything in Apple One or Apple One Family, but you do need multiple instances of Apple Music, Verizon has this $10/month perk, which is $7 less per month than buying it directly from Apple.

Walmart+: this is $3 less than buying it monthly from Walmart, though it is still more expensive over time than buying an annual $98 plan directly from Walmart.

100GB Mobile Hotspot: Unlimited Plus already offers 30GB mobile hotspot included, so most of those subscribers won’t need this, and Welcome Unlimited’s hotspot access might be on the slow side, but, on paper, this is the best value of any perk, a savings of $35/month off Verizon’s rack rate pricing.

Smartwatch Data & Safety: This is a package Verizon sells separately for $20 a month, but unless you specifically need the monitoring service (typically to send help in case of falls), there isn’t much of a discount here for smartwatch connectivity.

3 TravelPass Days: Verizon sells international roaming for $10 a day, making $10 for three a solid value relative to Verizon’s typical pricing. (There are usually less expensive local options, and Verizon doesn’t SIM lock its phones, but carrier roaming can be much more convenient.) Most consumers won’t need this perk regularly, but the TravelPasses roll over, so if you’re planning a week-long trip, you can sign up for this perk three months ahead of time to accumulate nine days of TravelPasses ahead of a trip, and then turn this perk off upon your return.

2TB Cloud Storage: Most consumers buying cloud storage from their carrier will use it for photos and video, but you could theoretically fill this up with anything. Verizon usually charges $15/month for this, so getting it as a perk saves 33%. However, cloud storage from Amazon, Google, Apple, or Microsoft all offer better integration with other apps and services, and are priced at or below Verizon’s perk price.

+Play $15 credit: In addition to Disney+ and Apple TV+, Verizon is offering access to a range of other content providers, including Netflix, Max, Paramount+, and Peloton, through its +Play portal. Like all perks, this can be attached to each line separately, so on a three-line plan you could get $45 towards +Play content for $30.

Pros and Cons

The beauty of this system is that consumers never have to pay for something they don’t want. If they don’t care about super-fast mobile downloads but want to watch Disney+ at a discount, they can do that on myPlan. Content bundles on rival carriers require you to buy the most expensive service plan. If they need their phone to serve as a hotspot while traveling, they can turn on 100GB of data for that month, and turn it off when they’re back. If they want Max and Disney+ – services not included in T-Mobile’s premium plans – myPlan provides a way to get them as part of a wireless bundle.

To prevent paralysis of choice, Verizon is leading with pre-made bundles. The three on the website are Unlimited Plus/Disney/Hotspot for “movie lovers,” an Apple bundle with Unlimited Plus and Apple One, and an Unlimited Welcome/Walmart+ combination for “shopping, savings, & more.” These may be reasonable starting points, but consumers will still want to consider alternative combinations, and they will also have to determine which lines needs which perks, which is not typically part of the family plan shopping process.

Verizon says it started with these nine perks, but it can adjust the offerings over time, giving it the ability to essentially create customized bundles targeting different customer segments. If Verizon executes on this in the future, segment-specific perks and bundles can be a powerful tool for targeted marketing. In addition to the front-end systems for ordering and changing your plan on the fly, there is a lot of back-end work on the provisioning and billing side. myPlan’s discounted service perks reflect years of negotiations with Disney, Apple, and other content providers originally for its mix & match plans and +play. None of this will be easy for competitors to replicate.

The initial response to myPlan in the press has tended to focus on whether the plan is more expensive, but that misses the point. myPlan will be more expensive for some people, and less expensive for others. It will absolutely cost more than any other plan if you add enough perks, but if the perks are good values and replace services you might otherwise purchase elsewhere, the fact that you are paying more to Verizon isn’t a problem. For every plan, perk, and price combination, myPlan only has the services that consumers value enough to pay for.

The challenge of myPlan is that it’s modular and the decision process is multi-faceted and complex. Figuring out what perks make the most sense for your family takes work, and choosing a wireless plan is already difficult. Verizon says that its research shows consumers want choice and flexibility. However, aside from power tools and fast-food dollar menus, consumers usually prefer to buy products with a feature set that matches as closely as possible to their overall needs rather than buy modular products or research and assemble a la carte systems. There are also up-front switching costs (in time and effort, not dollars) involved for anyone who already subscribes to the third-party perks. For example, existing Disney+ subscribers will need to cancel their existing Disney+ plan to take advantage of it as a Verizon perk or you’ll end up paying twice.

Actively managing a plan as often as monthly is also a behavioral change; most people select a plan when they change carriers or get a new phone and then don’t touch it for years. Of course you can set-and-forget myPlan, too, but then you miss out on the flexibility benefits that Verizon is hoping attract new subscribers in the first place.

The biggest challenge in the short term may be implementing this system smoothly at retail. Verizon has built an interactive configuration tool that helps consumers (or their sales rep) build the bundle. However, I suspect one area of confusion will be that some of the perks are individual, while some are family-wide. Further, many of the services being bundled here are not typically included with other wireless plans, widening the decision process beyond connectivity and phones to shopping, cloud services, and streaming media. It may be easier to start with fewer perks just to get consumers to sign up for myPlan now, and then upsell them on more perks later when they have a chance to review how much they are paying for the other services elsewhere. myPlan does allow you to change the makeup of your plan as often as once a month.

Competitive Response

A fully customized plan makes direct comparisons with AT&T and T-Mobile difficult. That can certainly work in Verizon’s favor, but if a fully built-out myPlan costs a lot of money, consumers may think it’s more expensive than rival plans that offer less or simply aren’t as customizable.

If myPlan proves popular, AT&T, T-Mobile, and the cable companies could superficially compete by offering different content bundles without matching the core flexibility and variety of perks that Verizon is providing with myPlan. However, they are more likely to focus on their areas of strength:

T-Mobile will likely ignore the flexibility involved and focus on the fact that Verizon is making you pay for its faster mid-band and mmWave 5G network access, while T-Mobile subscribers get its best network at all price points.

Having finally gotten out of Hollywood, AT&T isn’t talking much about content partnerships, and it is at a disadvantage in terms of mid-band 5G spectrum, so it can’t claim network leadership. However, offering heavy device discounts has been working well to keep subscriber growth up, so until Wall Street decides it doesn’t like that strategy, AT&T is likely to keep at it.

Cable companies have been stealing Verizon’s subscribers by offering them a different connectivity and content bundle: fast broadband and cheap TV packages with discounted wireless service. Ironically, these subscribers aren’t truly gone; they’re routed right back onto Verizon’s network, just at bulk MVNO rates. Cable MVNOs do have the negotiating power to pull together content bundles, but if changing your bundle requires waiting on hold in order to talk to a retention specialist, Verizon should be able to effectively attack any moves that look perk-competitive.

Finally, it must be noted that carriers continue to focus their premium brands on multi-line family and business users. That leaves individual subscribers for MVNOs (both independent and carrier-owned). The MVNO model can’t match myPlan’s breadth of perks, but should be able to continue offering significantly lower starting price points.

To discuss the implications of this report on your business, product, or investment strategies, contact Techsponential at avi@techsponential.com.