T-Mobile Capital Markets Day: Wireless Growth, FWA Expansion, and AI

T-Mobile held a “halftime” Capital Markets Day in New York this week to go over 2025 results and update guidance (press release here). I attended the event and met with T-Mobile executive management afterwards. Here are my top three takeaways:

T-Mobile Is Positioned for Further Growth

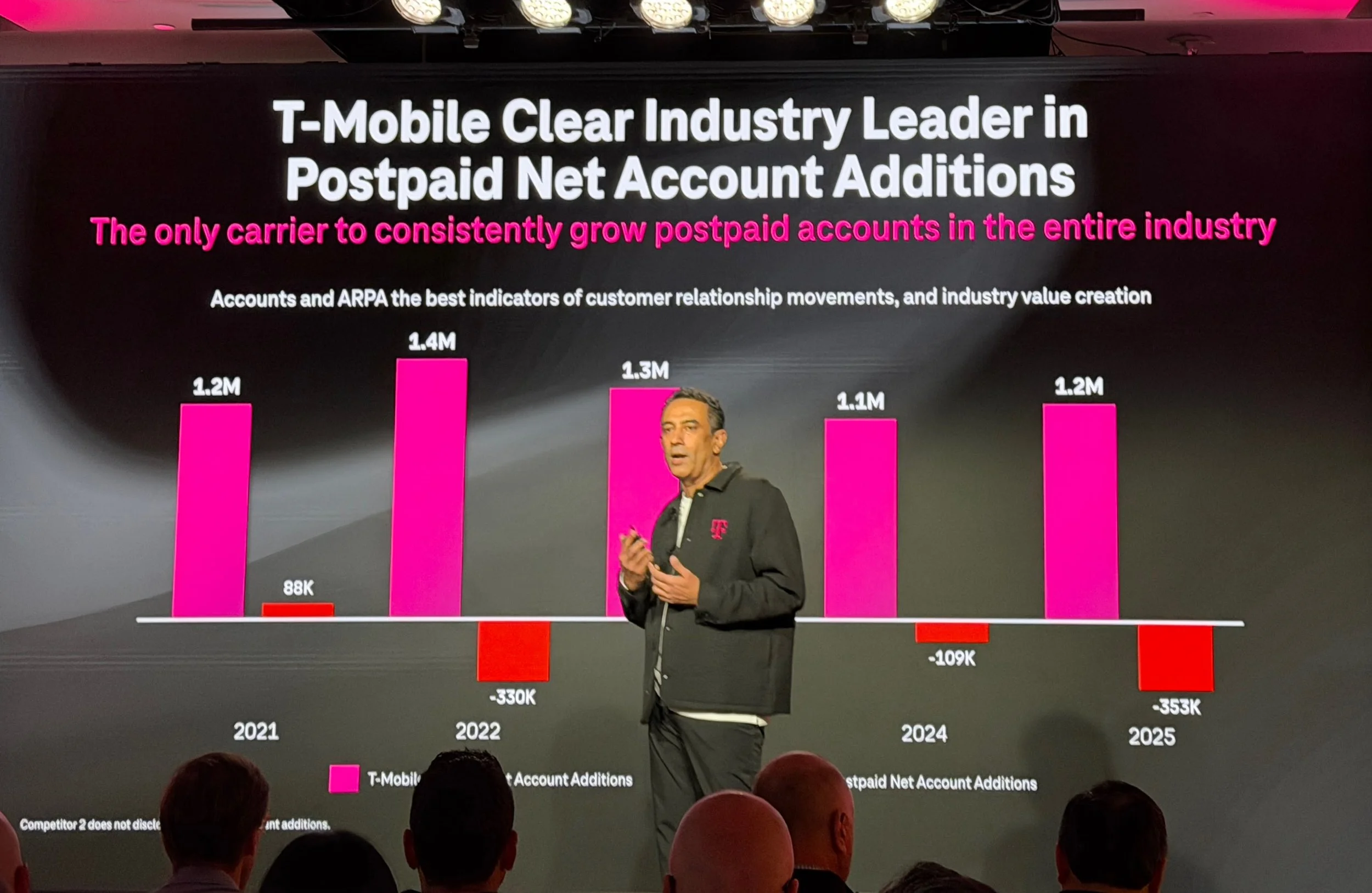

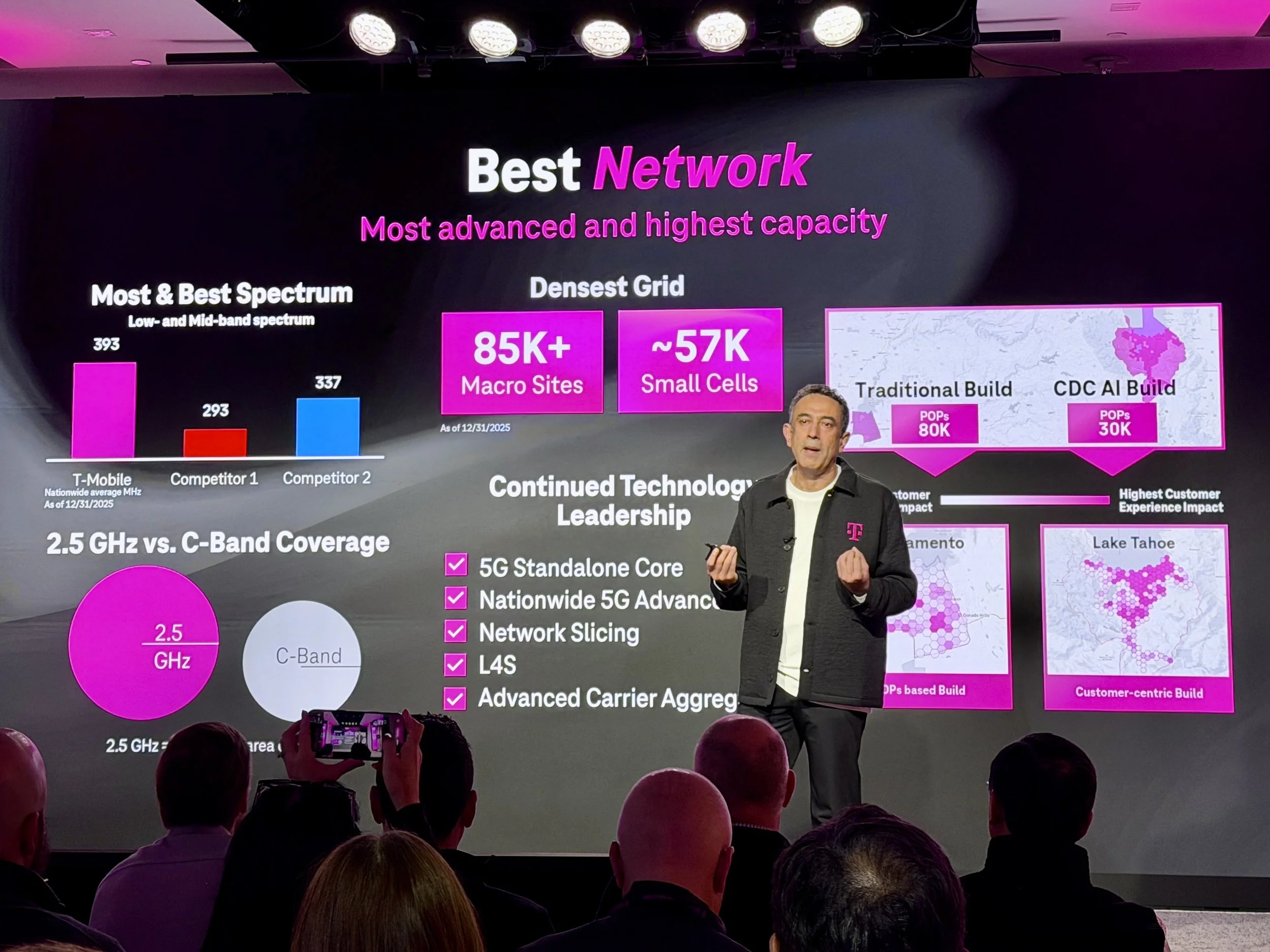

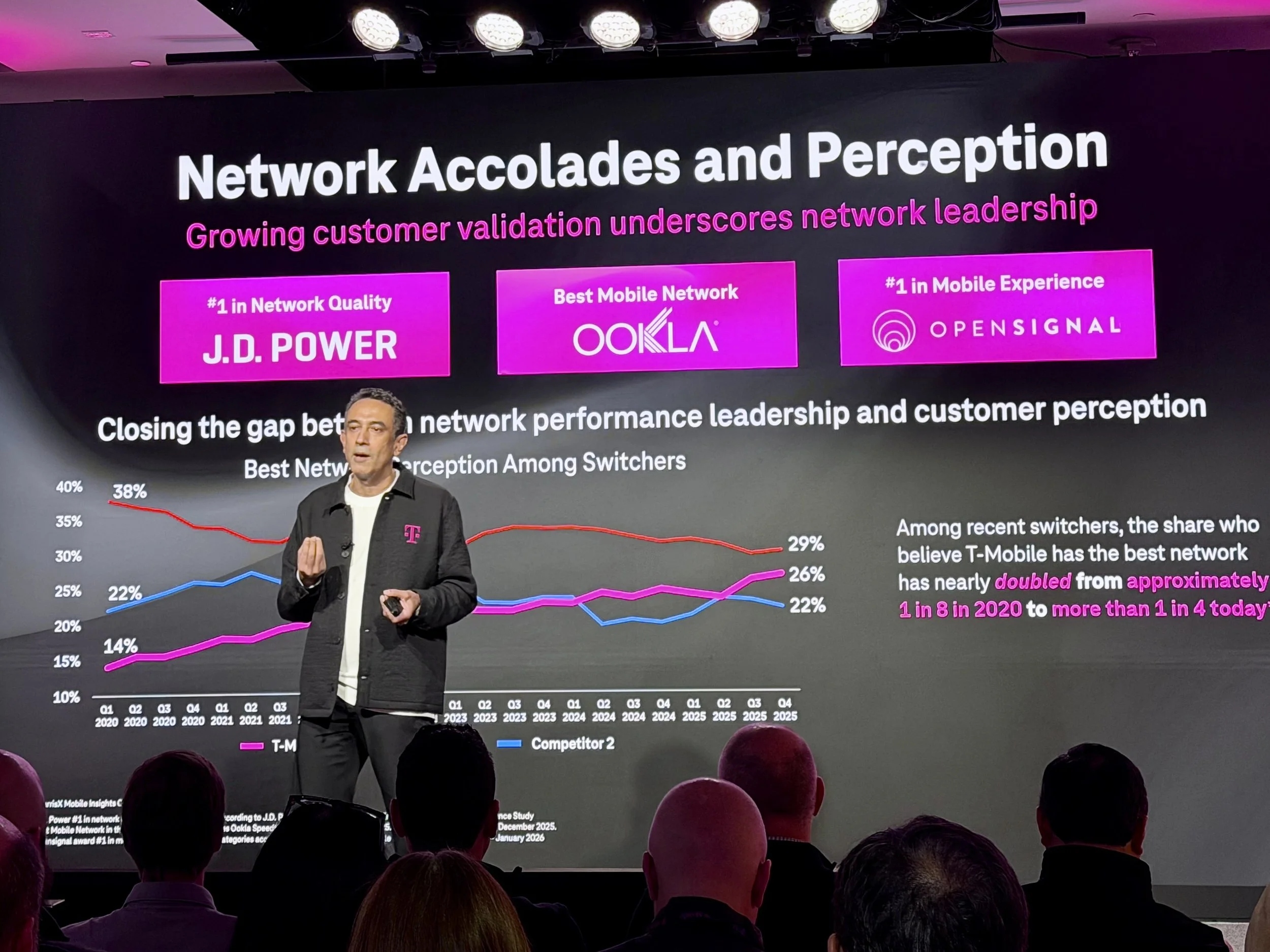

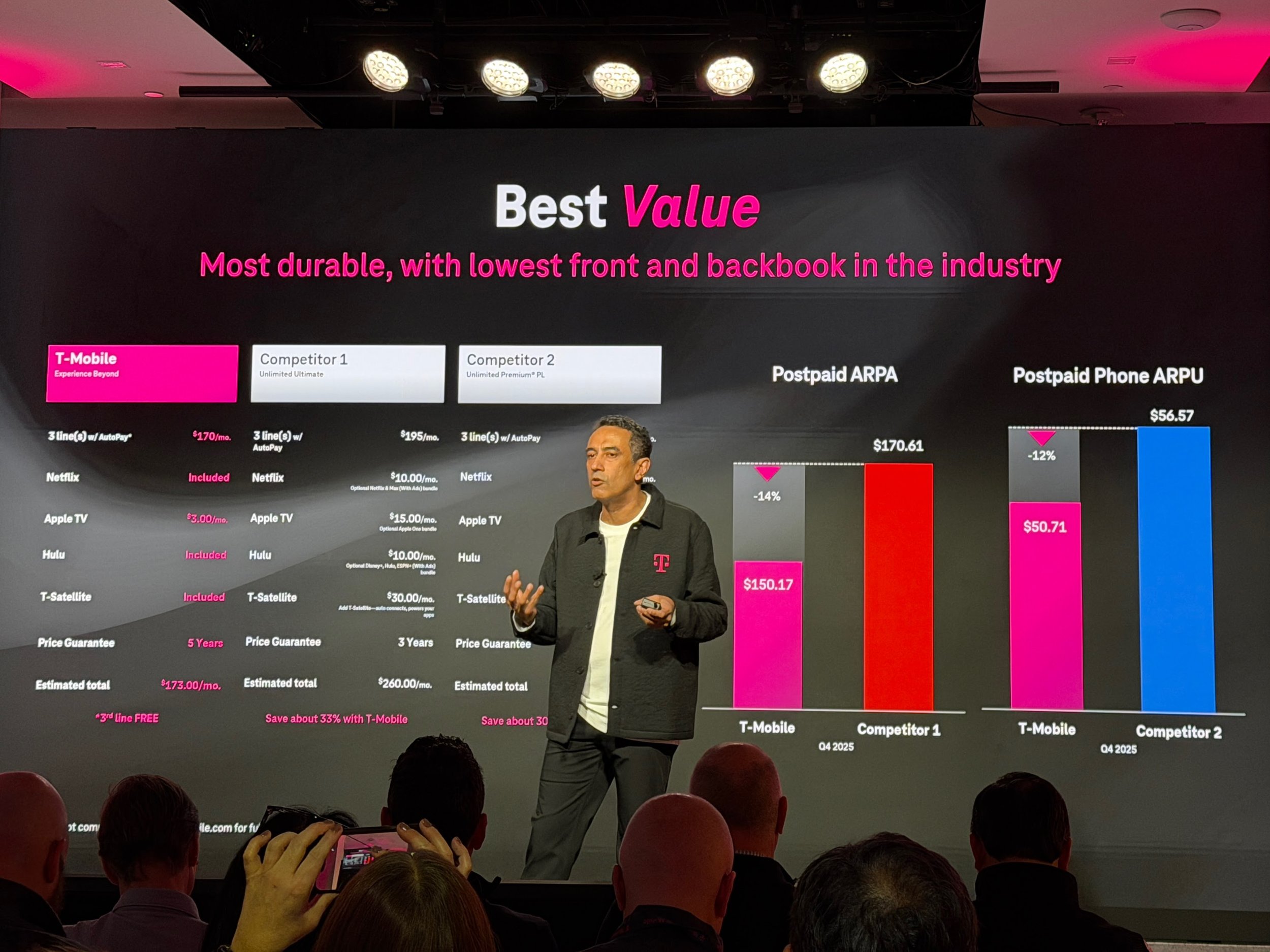

2025 was a really good year for T-Mobile: it led Verizon and AT&T on postpaid growth, new accounts, and fixed wireless. As T-Mobile has heavily advertised, it now has the best network according to various metrics from J.D. Power, Opensignal, and Ookla*. Every carrier claims that it has the best network, and, depending on how you define “best” and what and where you measure, they’re all correct*. In my testing, T-Mobile’s network has the best average speeds, which is not only great for fast file downloads, it is also a good indicator of network capacity, which means when the network is congested there should still be enough room for your streaming video without buffering, social feed scrolling or Facetime without frame dropping. There is more variability in network coverage by carrier; in any given location, AT&T or Verizon may have the best signal. However, even on coverage metrics T-Mobile can be the best, especially in areas where its low-band spectrum or lower positioned mid-band reach areas where higher frequency networks would require denser tower placement.

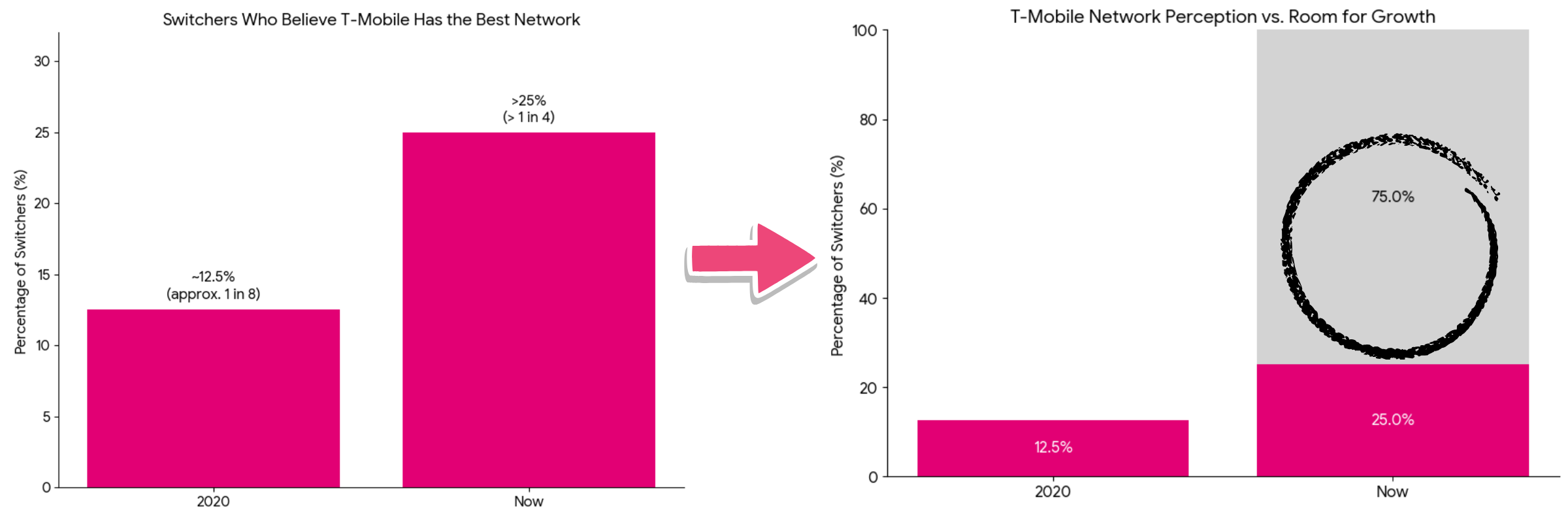

However, customer perception is only starting to catch up that T-Mobile’s network is excellent. T-Mobile says that surveys of people switching networks who believe T-Mobile has the best network nearly doubled from approximately one in eight in 2020 to more than one in four today. If you chart this out, the positive growth in perception is remarkable, but it still means that there is a lot of room for growth as T-Mobile gets its message out, especially in secondary markets where T-Mobile’s network coverage has improved the most.

T-Mobile’s strong postpaid growth does mask that its churn is up. One factor for the increased churn: incredibly generous carrier device incentives in the fourth quarter like Verizon’s 2025 Holiday promo that I wrote about. T-Mobile acknowledges that churn is up, but it still reports lower churn than rivals, and claims that the customers it added are more valuable than the customers who have left. In general, T-Mobile’s revenue mix skews higher for more recent subscribers as it emphasizes its premium plans.

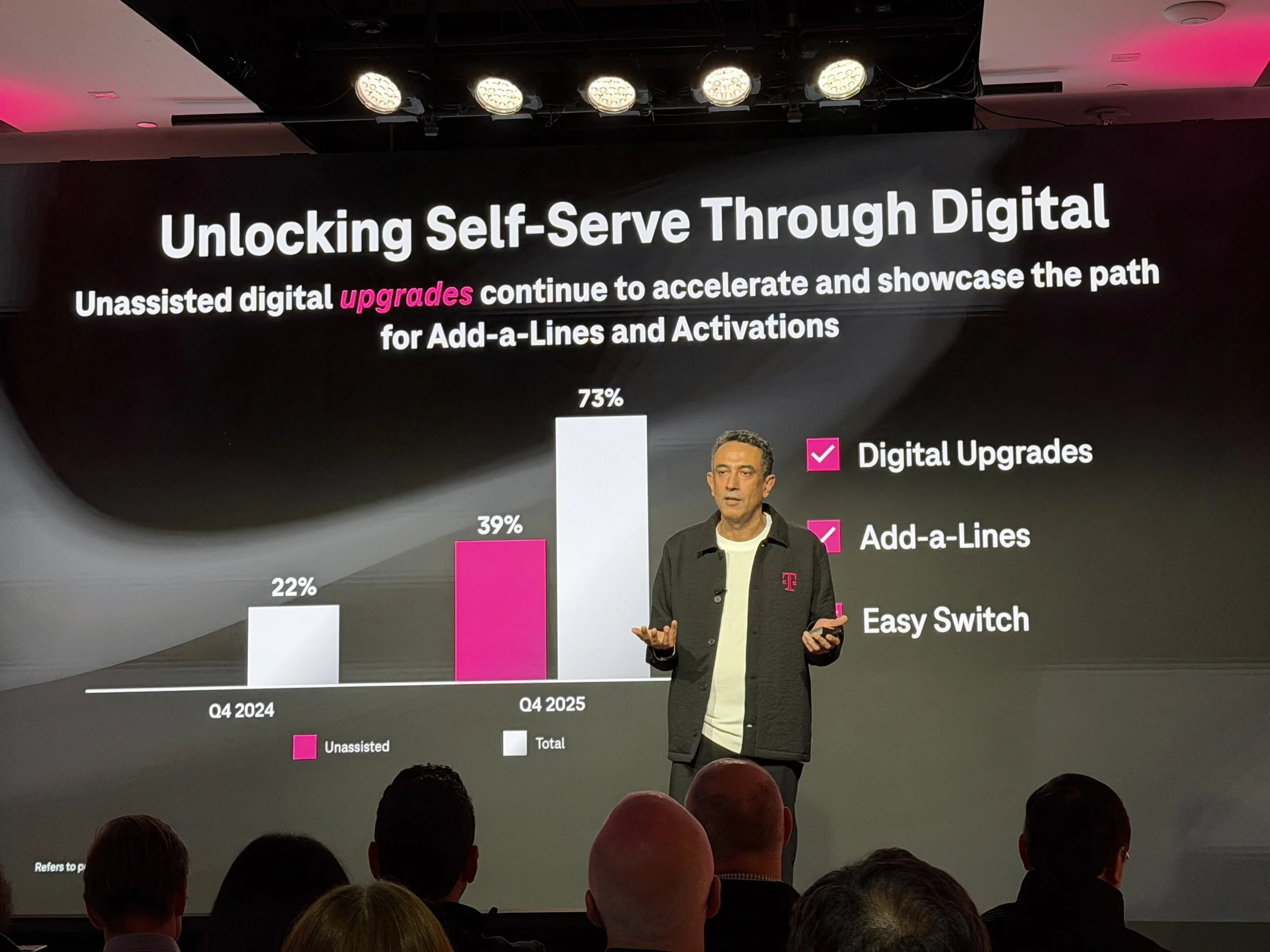

T-Mobile did not say how well its “15 minutes to switch” campaign has gone, but it did share usage numbers on the T-Life app for account changes. Nearly three quarters of all upgrades, line adds, and switching are done through the app. Most of these transactions are still guided by a T-Mobile representative, but an awful lot of T-Mobile subscribers – 39% – are upgrading themselves using the app.

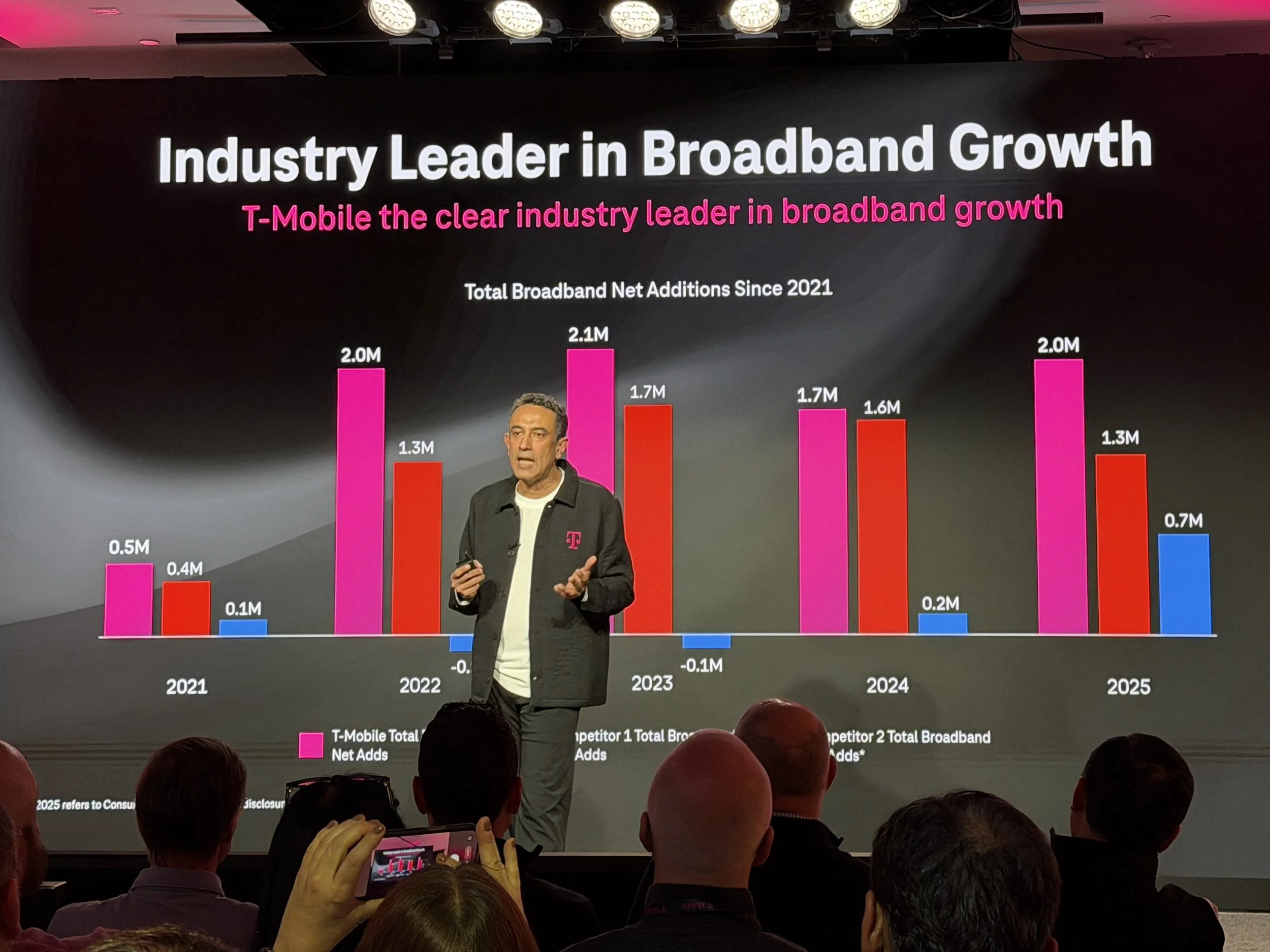

Broadband Opportunity Expanding

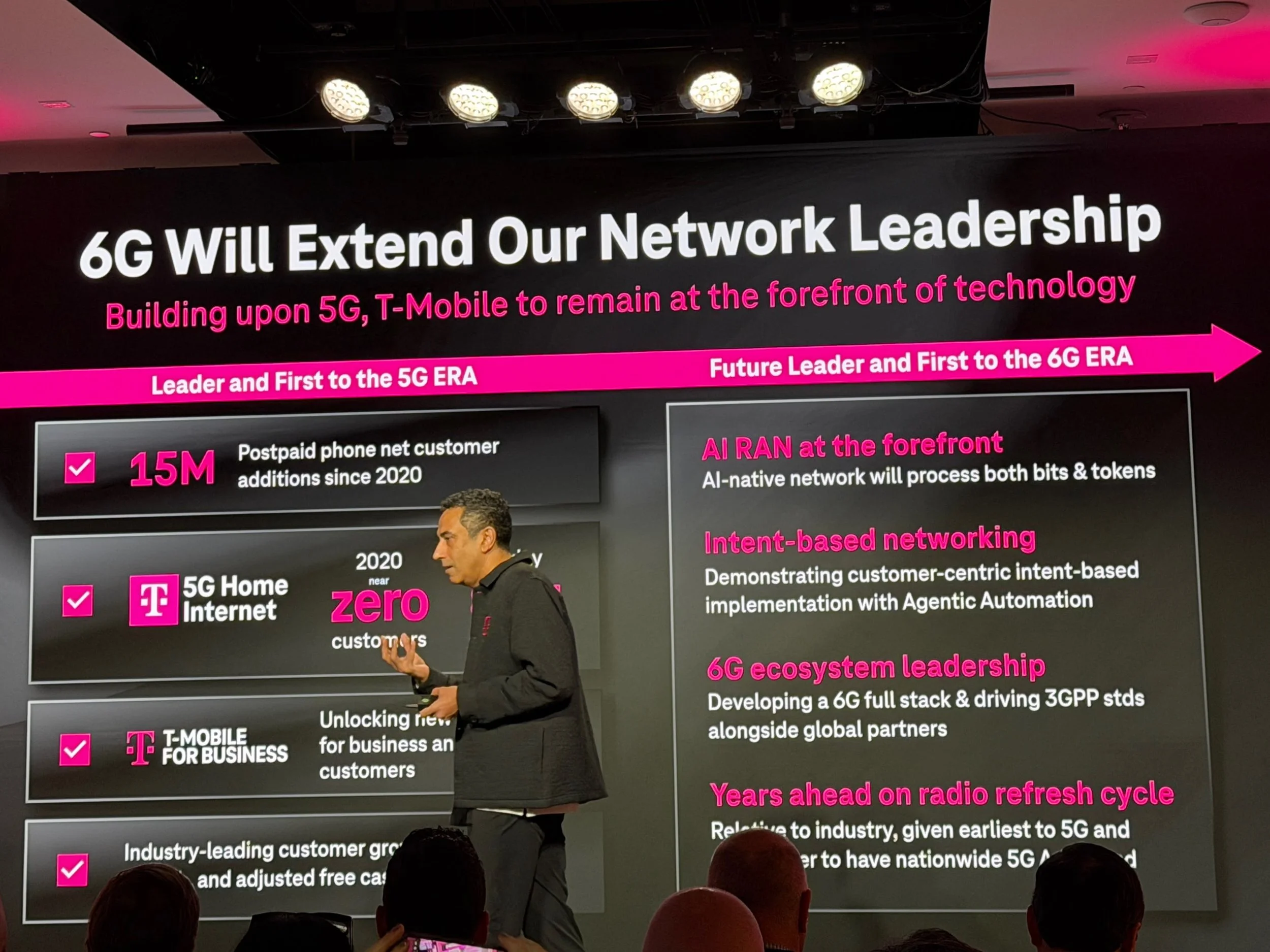

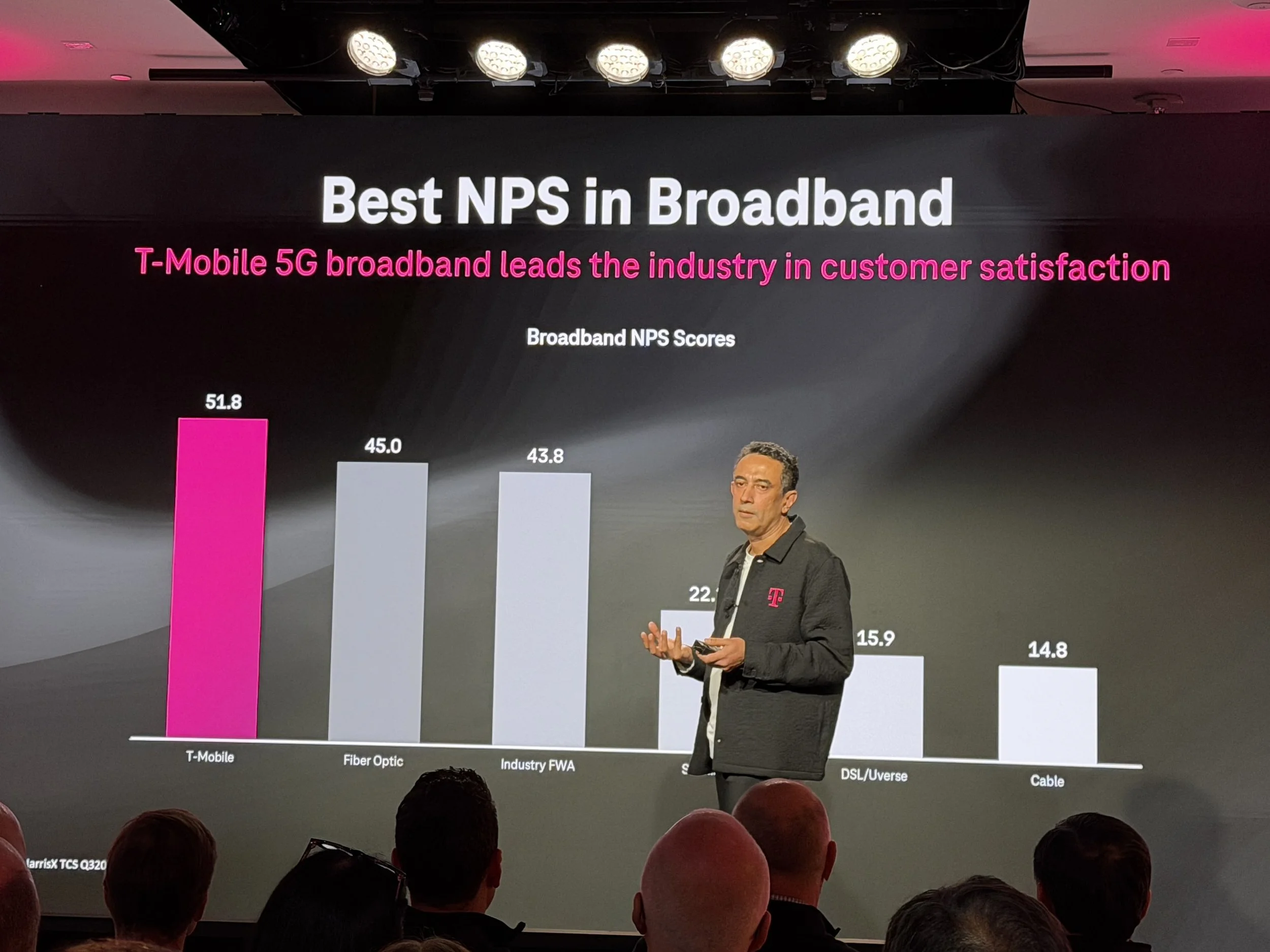

Infrastructure vendors and operators alike promised a lot during the Race To 5G™ but after the buildout it turned out that the only entirely new forms of monetization that 5G enabled were FWA (Fixed Wireless Access, aka wireless broadband) and, eventually, some network slicing. With its large cache of 2.5GHz spectrum and no existing fiber broadband installed base to disrupt, T-Mobile aggressively pressed FWA plans wherever its network could manage it without degrading wireless phone service. It’s working: T-Mobile reports that its FWA broadband gets higher satisfaction scores than fiber.

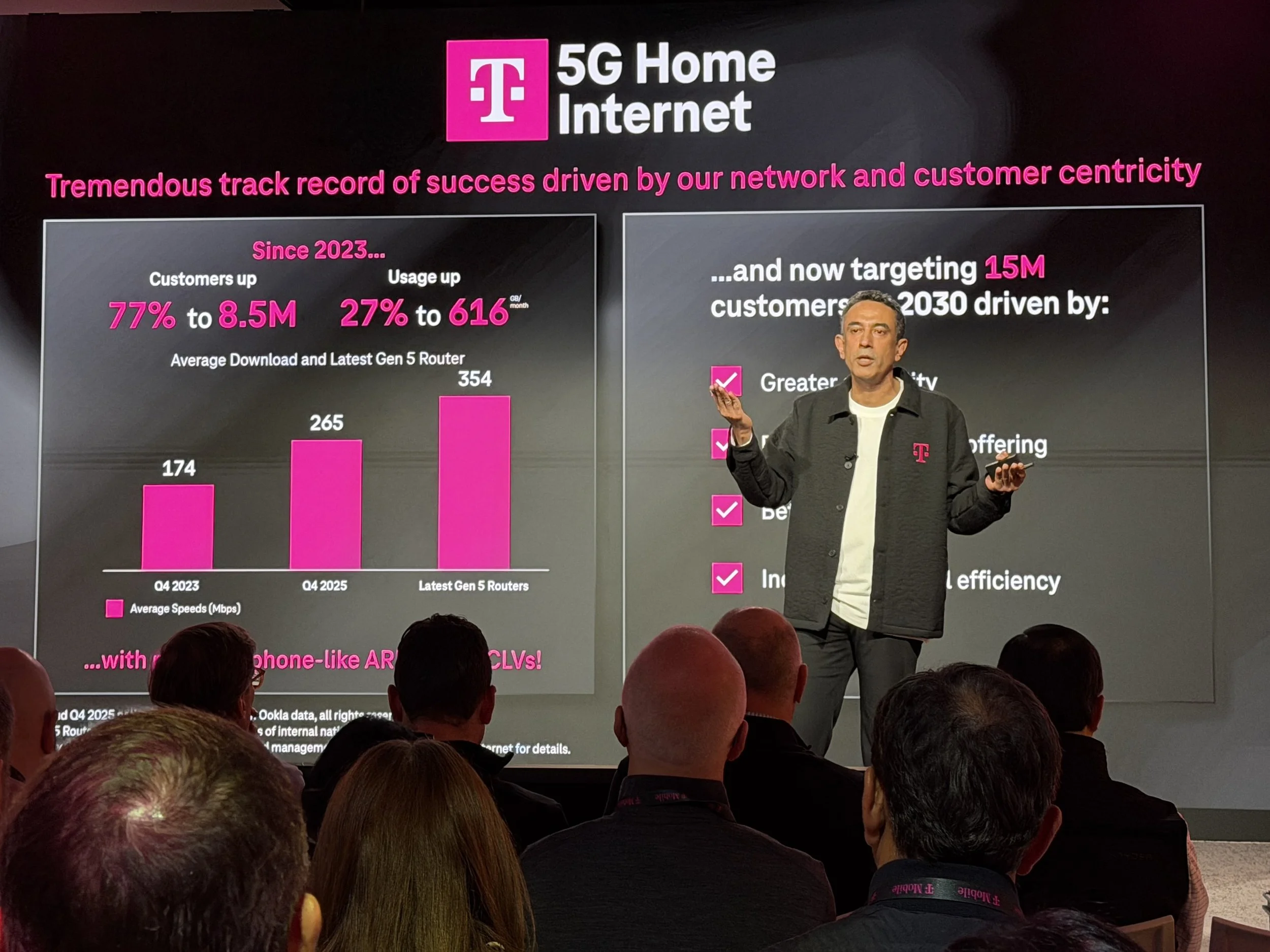

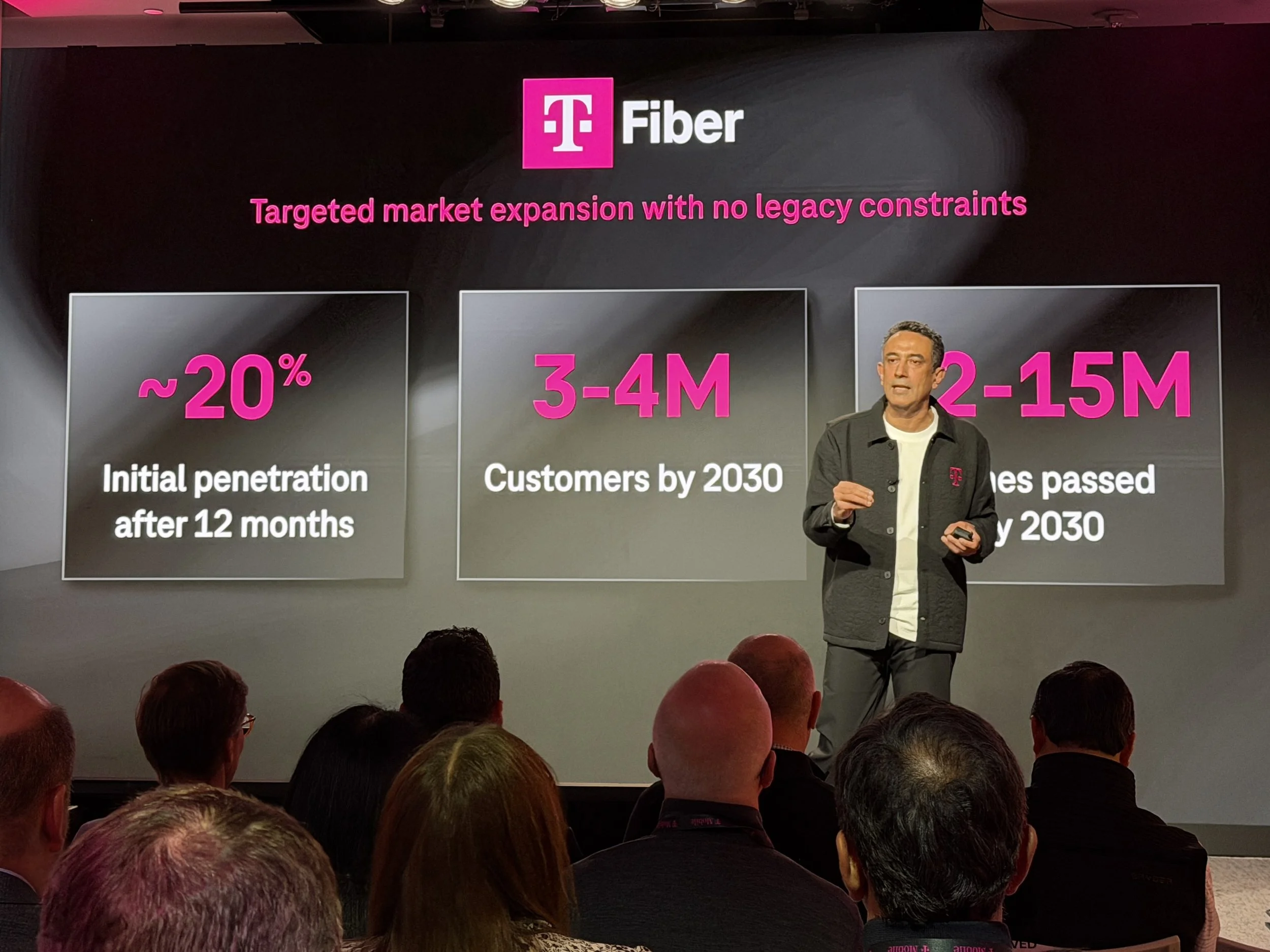

At the last Capital Markets Day, T-Mobile projected 12 million FWA accounts by 2028. At the start of this year, T-Mobile had over 8.5 million accounts, and it just updated its guidance to 15 million accounts by 2030, along with 3 – 4 million fiber households via its T-Fiber joint ventures. On the wireless side, T-Mobile still has a spectrum advantage and it started with standalone 5G before Verizon or AT&T, so it believes it has a sustainable advantage as it learns and optimizes its network. This is reflected in average FWA speeds rising as T-Mobile has added accounts.

AI, Ads, and Financial Services

FWA may be the main driver of non-phone-related revenue, but T-Mobile is also leveraging its nationwide 5G Advanced network to expand into advertising, financial services, and “long-term opportunities in edge and physical AI.”

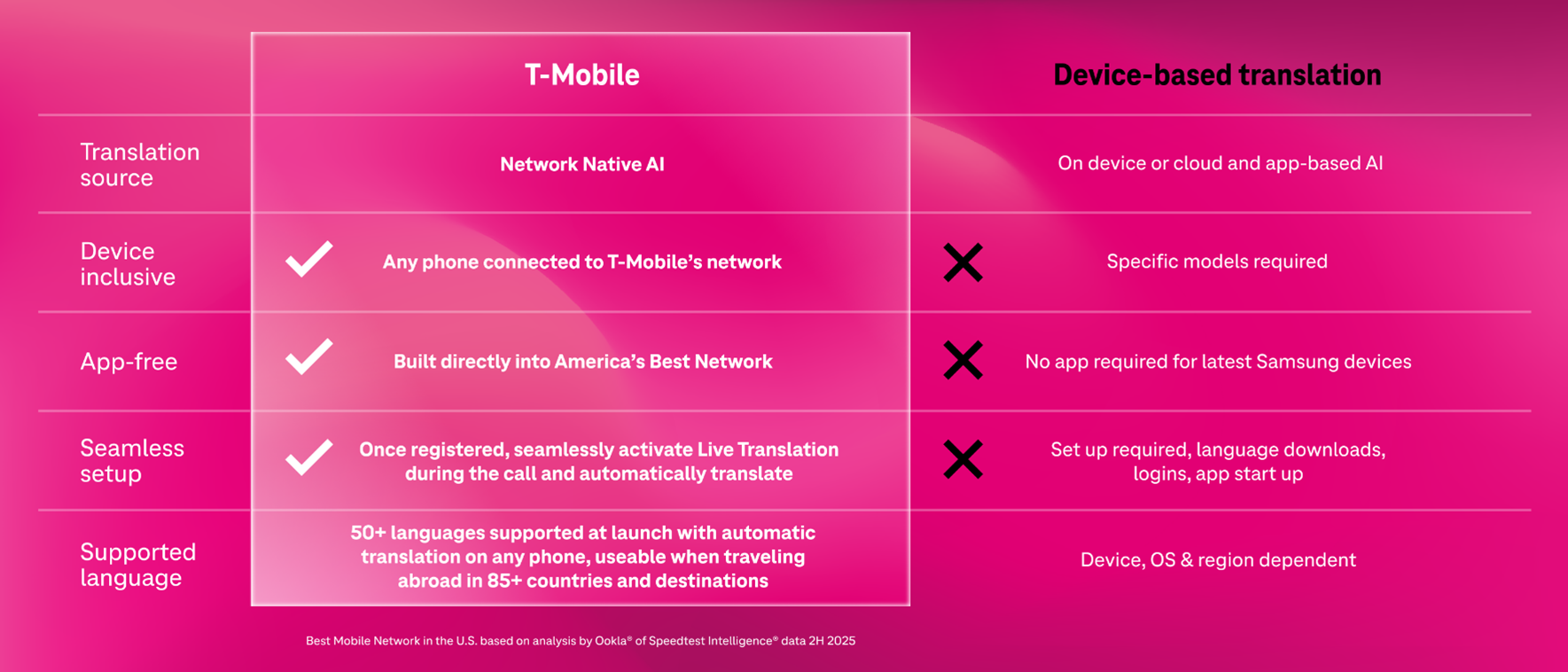

The first instance of edge AI services from T-Mobile is Live Translation, entering beta shortly, with access for selected users planned for this Spring and full launch later this year. The AI engine for Live Translation is being integrated directly into T-Mobile’s 5G Advanced network, making the low-latency service possible as long as one end of the conversation is on a T-Mobile 5G phone. That means you won’t need to download an app, won’t need both parties to have T-Mobile, and won’t even need a smartphone. You start a session by dialing *87* and the system automatically detects each language and starts simultaneous live translation in up to 50 languages. The system mimics each user’s own voice so that you sound like yourself in another language, not a bot. Later this spring, participants will be able to activate Live Translation without the short code by saying “Hey T-Mobile”.

T-Mobile imagines AI on its core network as a platform play, with potential APIs for third party integration and additional services beyond Live Translation. T-Mobile is not charging for the Live Translation beta, and during the Capital Markets Day session with financial analysts it did not pin any revenue or growth projections onto this or any other potential AI service. This allows T-Mobile to work through the inevitable growing pains and figure out pricing models without pressure; live translation may be a paid service, a feature of a premium plan, or a perk of all subscriptions.

For Techsponential clients, a report is a springboard to personalized discussions and strategic advice. To discuss the implications of this report on your business, product, or investment strategies, contact Techsponential at avi@techsponential.com.

* Verizon’s marketing almost exclusively focuses on coverage – though not 5G coverage. AT&T has been running attack ads saying that T-Mobile’s marketing claims are the most contested. That is absolutely true and also completely disingenuous: AT&T is the one contesting them! The fact that AT&T is attacking T-Mobile and not Verizon shows how far T-Mobile’s network really has come.