Qualcomm Snapdragon Summit 2021: Smartphone Position Safe (For Now); Questions On PCs and Gaming

Context

Qualcomm’s mobile chipsets defined a generation of smartphones, but the company finds itself stuck between a resurgent MediaTek – pushing higher into flagship tier smartphones for the first time – and key OEMs designing their own chips – Apple, Samsung, and now Google. On the compute side, Apple’s wildly powerful and efficient M1 processors have opened an opportunity for Arm vendors like Qualcomm to compete with Intel, but past Windows-on-Qualcomm efforts have underperformed. At its recent Investor Day, Qualcomm talked about the huge growth markets it is entering (automotive, fixed wireless, data center) to help diversify away from smartphones, but Qualcomm still intends to invest and compete in mobile and computing. It brought press and analysts to Hawaii for its annual Snapdragon Summit to outline just how it will do that.

Diversification Based on Smartphones, Not Away from Smartphones

Smartphone chipsets remain Qualcomm’s largest revenue center, and it is important to understand that when Qualcomm says it is working to diversify away from smartphones, that does not mean that smartphones are just a cash cow to be milked while R&D is invested elsewhere. In fact, Qualcomm is investing more in smartphones because smartphones are the gift that keep on giving: the IP needed to compete in smartphones is so comprehensive that it can be repurposed to enter adjacent markets. IoT devices look a lot like specialized smartphones. Automotive looks like a smartphone on wheels. Portable gaming is a smartphone with sustained GPU. Even data center and edge computing can look like a smartphone stretched in one direction or another.

It is therefore no surprise that immediately after reassuring investors that it has large new markets to conquer, Qualcomm unveiled new flagship smartphone SoCs, another generation of chips for mobile Windows PCs, and a new line of processors – plus a hardware reference platform – for handheld gaming.

Snapdragon 8 Gen 3: Still the (Android) Smartphone Leader (For Now)

Of the three big announcements at its Summit, the Snapdragon 8 Gen 1 smartphone platform is the most competitive. Qualcomm has improved performance enough, especially around imaging and AI, that Android OEMs will need to adopt it to maintain parity amongst themselves and compete with Apple. MediaTek’s new Dimensity 9000 will almost certainly win some benchmark battles (potentially faster CPUs and a more advance memory architecture should help), but Qualcomm has a more complete RF solution to sell alongside its SoCs, its modems offer mmWave today, and Snapdragon has higher consumer brand awareness. Qualcomm also has two other longstanding advantages: OEMs have already been designing their flagship phones around Snapdragon 8 series chipsets for years, and switching vendors during a supply crunch is a great way to get your other orders from Qualcomm deprioritized, and nobody can afford that. On the other hand, now that MediaTek has a competitive offering, vendors will want to keep Qualcomm honest by using it when they can.

Snapdragon 8 Gen 1 Key Features:

The new SoC is built using TSMC’s 4nm process with performance improvements across the board, though more on GPU (30% faster, plus features like volumetric rendering for atmospheric effects in games), battery life (“1.7x more power efficient”) and AI (4x improvement) than CPU.

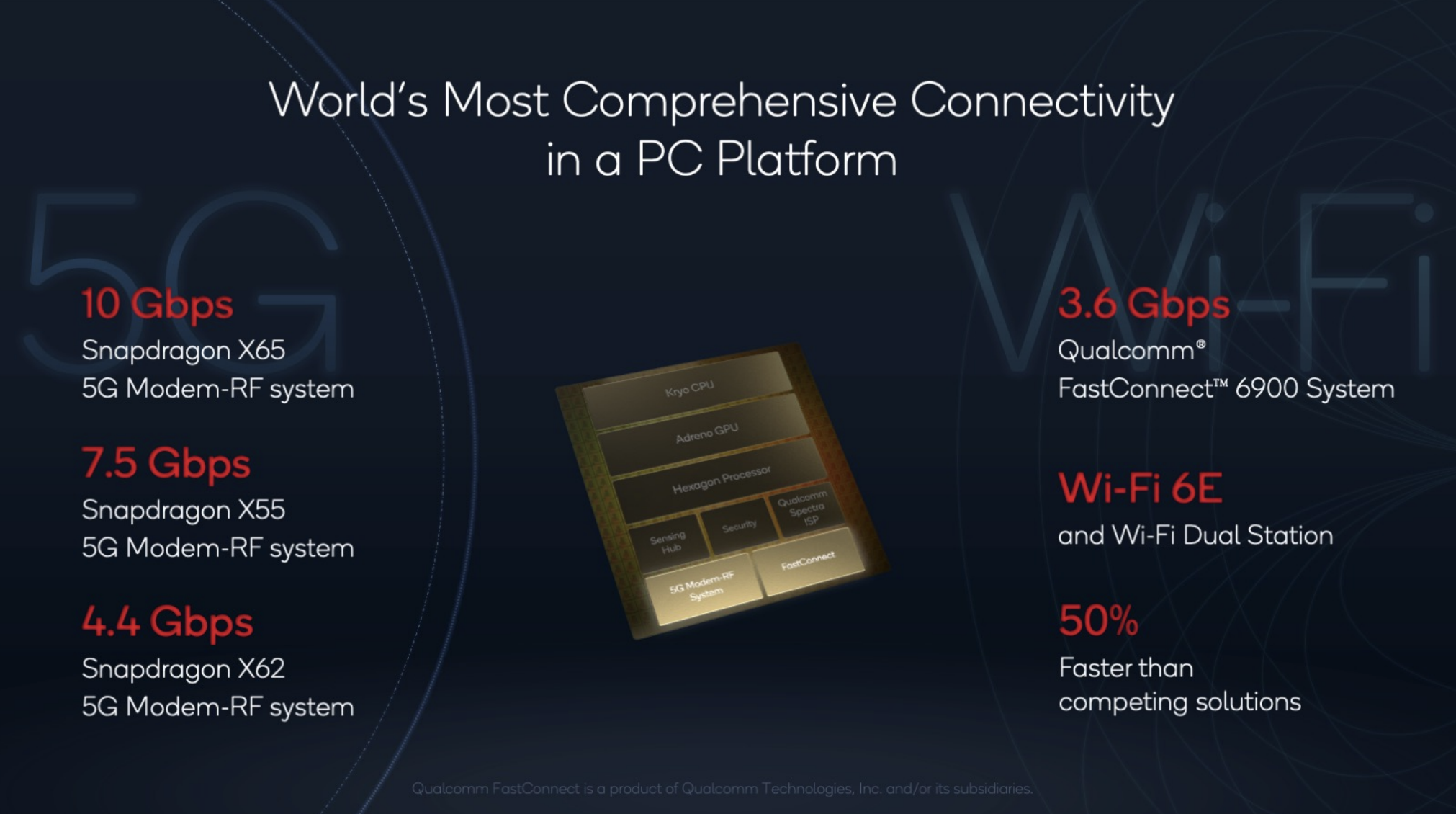

Integrated 5G Release 16 X65 modem with the most comprehensive sub-6 and mmWave capabilities on the market. Plus Wi-Fi 6E.

Impressive imaging capabilities including an 18 bit ISP that supports 8K video encoding, a “5x better night mode.” There is also a new relationship with Ernst Leitz Labs with "Leitz Looks modes" to mimic Leica camera output. Snapdragon Imaging now gets its own Snapdragon sub-brand badge alongside Snapdragon Audio and Snapdragon Elite Gaming.

The most controversial feature is a separate ISP that can power an always-on camera. Qualcomm is positioning this as a way to increase security by locking your phone when you aren't looking at it, and identifying if someone else is peering over your shoulder. However, an always-on camera introduces its own security questions: is that data being stored somewhere? Can someone hack your phone and watch you? Qualcomm says no to both, but the feature won't be sold to consumers by Qualcomm; the phone manufacturer is going to have to convince consumers that they want this, and some of these brands have spotty reputations for privacy.

Qualcomm repeatedly stressed the inclusion of Snapdragon Audio, which provides CD lossless audio if, and only if, the entire chain from content to phone to headphones is compatible. This will rarely be the case for consumers – Qualcomm has none of the largest earbud and headphone OEMs signed up – and audio quality has never been a consumer purchase driver, no matter how many times companies from ZTE to Sony have tried selling it.

How Big a Risk is OEMs Designing Their Own Chips and Displacing Qualcomm?

Competition from MediaTek’s Dimensity 9000 must be taken seriously, but with the Snapdragon 8 Gen 1, Qualcomm has done enough to maintain its position as the SoC of choice for super-premium Android smartphones. Or has it? Designing your own silicon is difficult and expensive, but it can be a great way to differentiate your device. If volumes are high enough, using custom processors designed in-house (and typically built by TSMC) can improve profit margins.

Samsung has decades of experience in semiconductors and modems, and it designs – and manufactures – its own SoCs for some of its phones. Google had been buying Snapdragons is now using its own internally designed Tensor chips because it has silicon expertise and is looking to differentiate with AI. Google was not a large client for Qualcomm, and the loss is dwarfed by the opportunity to fill the gap created as Huawei has been forced to pull back from the smartphone market using its own processors. OPPO is designing its own ISPs today and is reportedly working on SoCs for its 2023 or 2024 phones. If successful, it would naturally follow that OnePlus and possibly other companies under the BBK umbrella would use them as well.

However, competition is fierce: Apple sets a very high bar, and Qualcomm and MediaTek are pushing hard to keep up. If you cannot homologate the SoC across multiple markets – a Qualcomm specialty – you won’t might not achieve the volumes necessary for the economics to work. If your in-house chip does not provide the same performance, functionality, connectivity, and power efficiency than what you can buy from Qualcomm, MediaTek, or Samsung, your phone will be less competitive, not more. In the end, designing silicon requires more expertise than licensing cores from Arm and calling up TSMC, and while some companies possess the expertise and the financial strength to risk it, we expect most smartphone vendors will buy vs build.

Qualcomm’s Latest Bid for PCs

Four years ago at a Snapdragon Summit in Hawaii, Qualcomm announced its first foray into chipsets for Windows convertibles. Qualcomm promised performance as good as Intel, app updates over cellular in the background, and weeks of battery life. (Qualcomm later backtracked that to “days” of battery life, but the original claim was “up to two weeks.”)

None of it was true. Performance wasn’t comparable to Intel, apps were not architected to stay updated in the background, and battery life – though excellent – was still measured in hours. Even battery life that stretched over 12 hours was not differentiated; plenty of PC OEMs built long-lived laptops using Intel’s low power chips. To make matters worse, Microsoft left huge compatibility holes on the software side: it didn’t bother updating most of its own apps to run natively on Arm, and many apps couldn’t run on the platform even in emulation. Techsponential has tested multiple Qualcomm-based Windows devices from Samsung, HP, and Microsoft, and the best that you can say is that they had attractive, fan-less hardware designs. Qualcomm Windows devices were not cheaper than Intel, they were slower, and they had confusing app compatibility issues. They haven’t sold well.

However, Qualcomm never gave up, and then Apple provided Qualcomm with a gift: Apple’s M1 processors benchmark better x86 at lower power draw, and, thanks partly to an array of special-purpose cores, run x86 Mac apps better in emulation than they ran natively on Intel. The M1 proved without a doubt that silicon running Arm instruction sets can be wildly competitive. Now, that isn’t the same as what Qualcomm, MediaTek, Samsung, and others are doing – Apple designs its own cores that use the Arm instruction set, it isn’t licensing Arm’s designs – but it’s close enough to generate enormous interest from PC OEMs in any next-generation architecture that can compete with Apple. (Intel and AMD are obviously working hard to improve their power efficiency, too, and they are hammering home their advantage in gaming, which is actually less about performance per watt and GPU capabilities and more about software dependencies.) Microsoft is finally creating native versions of some of its key SAAS apps like OneDrive, Adobe has ported a few of its Creator apps, and emulation is now available for most other 64-bit x86 Windows apps.

With this context, Qualcomm is announcing the Snapdragon 8cx compute platform Gen 3. (Yes, that's the full name.) Windows still has a fairly weak native app story on Arm, and some categories will never run in emulation (ex: hardware-based encryption) without a rewrite. Still, now that legacy Windows apps work in emulation, all Qualcomm needs to do is prove that Snapdragon 8cx Gen 3 delivers a better overall experience than Intel. Qualcomm is claiming 60% better performance per watt on CPU and 40% better GPU performance per watt than Intel’s current Core i5. Of course, those numbers are for native performance, not emulation, Intel is expected to launch new 12th generation processors at CES, and these new Qualcomm chips are not out yet.

While there are clearly improvements over the last generation Snapdragons, it seems unlikely that Qualcomm will have compelling differentiation on real-world performance without a huge push for native app conversions from software developers. Qualcomm itself seems to realize that, promising Nuvia-based SoCs at the end of next year. In the meantime, Qualcomm gave a preview of use case messaging for the 8cx Gen 3:

AI echo cancellation and noise suppression during video calls

On-device face detection and transcription

Low latency connectivity (both 5G and the latest generation WiFi) for cloud gaming

Secure boot and SPU for Microsoft Pluton

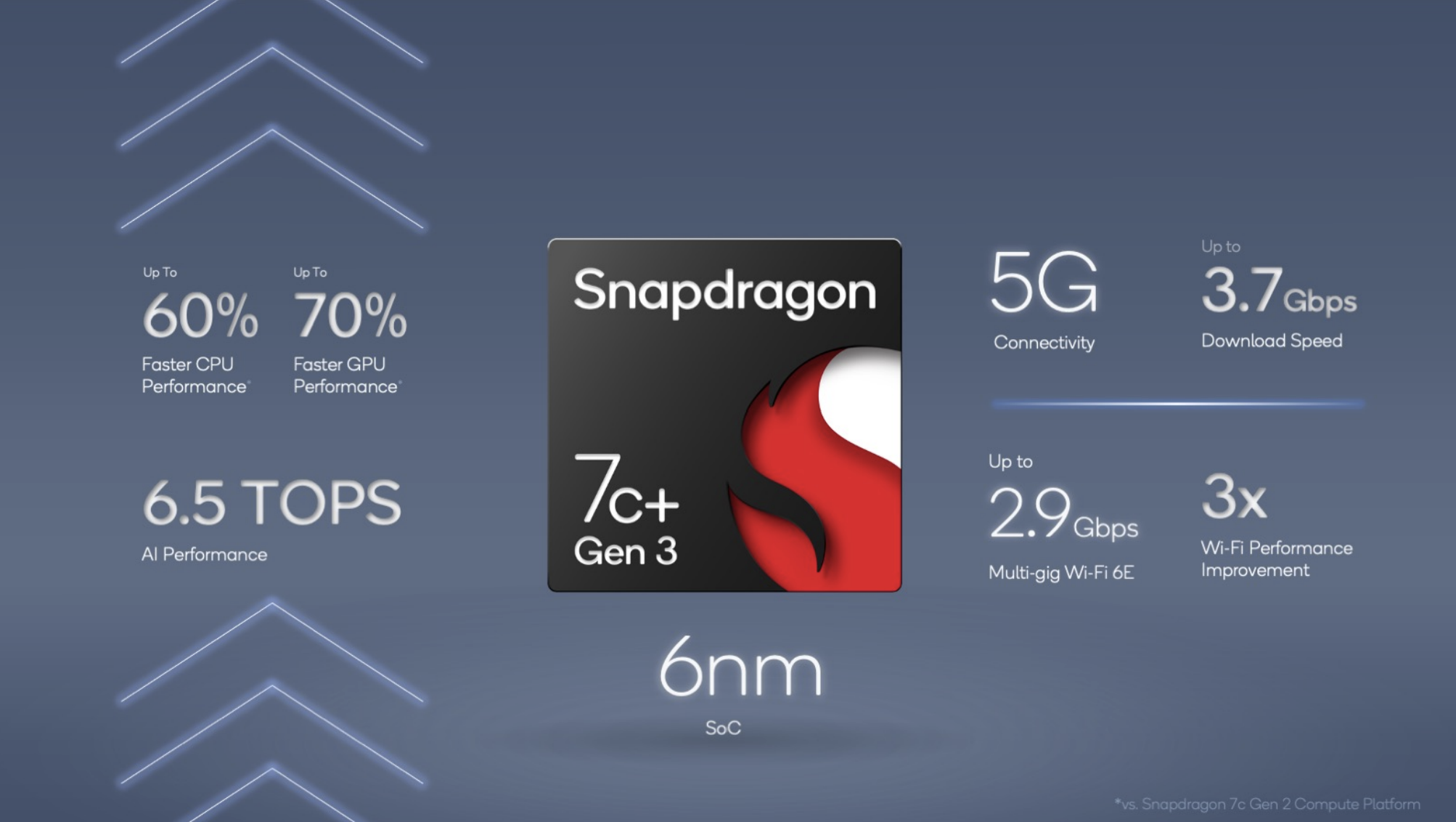

Qualcomm is also updating its entry tier Snapdragon compute platform, the 7c+ Gen 3. Big upgrades include 5G, and faster CPU, GPU, and AI, all aimed at lower priced laptops and convertibles. The 7c+ Gen 3 is due out first half of 2022 with Acer, HP, and Lenovo on board. The 7c+ Gen 3 has all the same issues as the 8cx Gen 3, only moreso, as apps running in emulation should perform worse. However, the inclusion of 5G is unique for laptops and convertibles at this price point, so if vendors or carriers can sell that functionality – something they’ve struggled to do in the past – it will be differentiated.

Mobile Gaming Platform

Qualcomm has over 1600 non-smartphone design wins, and Snapdragon phones are certainly used for gaming, so it is understandable that Qualcomm would try to parlay that into a dedicated handheld gaming platform. The Snapdragon G3X is an SoC that looks a lot like a Snapdragon 8 Gen 3 if you optimize it for sustained GPU performance. Qualcomm further understands that game platforms succeed or fail based on games, and so it teamed up with Razer to build a reference kit for developers. The idea is to get developers excited about the platform to target its featureset and remap touchscreen controls for the joysticks and buttons on the G3X reference design.

At the Summit, Qualcomm spent most of its G3X time talking about the Developer Kit as if it is going to be a real product sold to consumers, highlighting features like a 1080p webcam for streamers, 4K TV docking, and XR viewer connectivity. This is in addition to a large 6.65” 120Hz 1080p OLED display, a 6000mAh battery, and mmWave 5G. If this was an actual retail product, it would be awfully expensive.

The G3X Developer Kit looks like great fun, but we are deeply skeptical that Qualcomm can succeed here. Gaming platforms usually need a driving force behind them to ensure that they get enough unique, compelling content. This often means first party game studios – Microsoft and Sony own several, while Nintendo is arguably the world’s best gaming developer that happens to sell hardware. Complementing that, there needs to be clear ROI for third party developers – Windows is such a large target market that it attracts investment, and Meta was funding and subsidizing games for the Oculus Quest before it started buying up content creators, too.

Silicon vendors don't have the business model to pull that off. NVIDIA tried a nearly identical strategy with the Shield only to discontinue it and focus on streaming TV hardware. Nintendo sells hardware at a profit by keeping the BOM cost low, and then makes money on its own games and third party licensing. Qualcomm can’t do that – it isn’t selling the hardware itself, any G3X hardware will be more expensive than a Nintendo Switch (let alone a DS), and Qualcomm doesn’t sell software. Microsoft and Sony sell hardware at a loss and make money on first party software, services, and third party licensing. Qualcomm can’t do that, either, both because it doesn’t control hardware sales, it doesn’t sell software or services, and Android isn’t exclusive enough to justify third party licensing fees.

To discuss the full implications of this report on your business, product, or investment strategies, contact Techsponential at avi@techsponential.com or +1 (201) 677-8284.

Qualcomm Snapdragon Summit Live Twitter Coverage

For additional context, Qualcomm presentation slides, and some light snark, here is my live coverage on Twitter in three threads:

· Day 2, Part 2 (Smartphone details)

· Day 2 (Metaverse, Mobile PC, Portable Gaming Chip/Developer Kit)